Amazon launches ad tech activation partners program

Company formalizes DSP partnerships to expand advertiser access and provide specialized training support.

Amazon Ads introduced a formal structure for its ad tech activation partner program, establishing clear requirements and benefits for third-party companies supporting Amazon DSP campaign management. The company announced these partnerships through official documentation and LinkedIn communications that began circulating within marketing communities this week.

According to Amazon Ads documentation, ad tech activation partners represent "third party partners who have expertise in Amazon DSP campaign management" and can "help you get the most out of Amazon DSP by acting as an extension of Amazon DSP's sales and support teams." These partnerships address specific customer needs including onboarding support, ongoing training, and expert guidance for campaign optimization and reporting.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Amazon Ads introduced the formal ad tech activation partner program, affecting third-party companies with Amazon DSP expertise, including established agencies like Amerge Ltd., Xnurta, Acadia.io, and technology providers such as Quartile and Pacvue.

What: Amazon formalized requirements and benefits for ad tech activation partners, establishing clear criteria for partnership approval including technical proficiency, multi-year performance records, Amazon Marketing Cloud support capabilities, and comprehensive security audits.

When: The formalization occurred through documentation and LinkedIn communications that began circulating within marketing communities this week, building on partnerships that have existed since 2015.

Where: The program operates globally through the Amazon Ads Partner Directory, with 234 current partners offering Amazon DSP services across North America, Europe, Asia-Pacific, and emerging markets.

Why: The program addresses customer needs for Amazon DSP access below minimum spend thresholds, provides onboarding support and training, and extends Amazon's reach through vetted third-party expertise while maintaining platform service quality standards.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

The formalization process establishes three core benefits that all Amazon ad tech activation partners must provide. First, account creation and ownership through the partner's Amazon DSP seat enables access for customers who do not meet minimum spend thresholds. Second, onboarding support includes both technical account setup and internal training for requesting customers. Third, ongoing expertise encompasses guidance on best practices and training for new feature releases.

Amazon's documentation reveals that becoming an activation partner requires demonstrating technical proficiency and strong Amazon DSP performance over multiple years. Candidates must show ability to offer Amazon Marketing Cloud support and provide additional services such as software-as-a-service solutions, technology support, or third-party technical assistance. The approval process includes passing Amazon Ads' security requirements, which involves a comprehensive audit of information security processes and procedures.

Current partnership listings in the Amazon Ads Partner Directory showcase 234 results for Amazon DSP services across various specializations. The directory includes established agencies like Amerge Ltd., which offers 37 services and 11 products with 9 certifications, and Xnurta, which provides 36 services powered by artificial intelligence for bid optimization and competitive keyword harvesting. Full-service agencies such as Acadia.io have been managing Amazon brand accounts since 2015, while technology providers like Quartile focus on proprietary machine learning platforms for campaign automation.

According to the documentation, activation partners provide value-added services beyond basic access requirements. These include measurement and reporting tools, campaign management and optimization platforms, and integration with other advertising technology and marketing automation systems. Partners like Skai offer sophisticated reporting and budget forecasting capabilities, while companies such as Pacvue provide unified retail analytics combining sales, inventory, and marketing data.

The partner program operates through a seat-sharing model where customers use the activation partner's Amazon DSP access rather than obtaining direct platform licenses. This approach reduces platform fees for customers from 10% to 7-10% of media spend, depending on the specific partner agreement. Service fees typically range from 3-5% for self-managed accounts with partner guidance to 15% for full campaign management services.

Amazon's case study documentation highlights successful implementations of activation partner collaborations. Kia Country of Savannah worked with activation partner Revive to achieve a 98% video completion rate on Streaming TV placements while maintaining cost efficiency and increasing click-through rates by 120%. The automotive dealership sought to reach local car buyers throughout their shopping journey using Amazon DSP's targeting capabilities combined with Revive's platform expertise.

Another documented case involves Sports Research launching their Hydrate product through partner Pacvue's commerce platform integration. The collaboration utilized signal-enhanced streaming television deals through Amazon DSP, overlaying custom Amazon Marketing Cloud audiences with broadcaster content signals. Results included 1.8X uplift in on-target reach, 51% improved cost efficiency, and 43% more impressions delivered compared to control campaigns.

Partner requirements extend beyond technical capabilities to include specific Amazon DSP performance metrics and customer retention abilities. The documentation specifies that partners must demonstrate growth and retention success over extended periods, suggesting Amazon evaluates partnership applications based on quantifiable performance data rather than preliminary qualifications alone.

Regional availability varies across activation partners, with some focusing on specific geographic markets while others operate globally. The partner directory indicates service coverage spanning North America, Europe, Asia-Pacific, and emerging markets, though individual partners may concentrate their expertise in particular regions or industry verticals.

Customer guidance for selecting appropriate partners emphasizes business needs assessment and partner status evaluation. Amazon awards verified and advanced partner status badges to organizations demonstrating expertise, engagement, and successful advertiser growth. Additional partner awards recognize exceptionally innovative campaign development and client service excellence.

Amazon's documentation provides a detailed comparison table outlining four distinct DSP campaign management models, each targeting different business needs and budget levels. The comparison framework divides customer requirements into three primary categories: outsourcing campaign management entirely, managing campaigns independently, or seeking partial management assistance.

For advertisers wanting complete campaign outsourcing, Amazon offers two pathways. The Amazon-managed option requires a substantial $50,000 minimum campaign spend, with Amazon directly handling all campaign operations through internal seats where customers lack direct platform access. This premium service carries a 15% service fee plus 10% Amazon DSP platform fee, totaling 25% of media spend. The agency-managed alternative through activation partners provides identical campaign expertise with variable minimum spend requirements depending on the specific partner, maintaining 15% service fees but reducing platform fees to 7-10%, resulting in 22-25% total costs.

Self-managed advertisers seeking complete campaign control can access Amazon DSP through activation partner seats without minimum spend requirements. This model provides DSP access, account setup, and partner-provided customer support and training for 3-5% service fees plus 7-10% platform fees, creating the most cost-effective option at 9-15% total media spend. Customers manage campaigns directly through Amazon's self-service console while receiving technical guidance from their activation partner.

The hybrid "self-managed with reseller guidance" model bridges independent management with expert assistance. Amazon ad tech activation partners help customers onboard, receive training, and provide ongoing campaign management support. This approach maintains the partner seat structure with 15% service fees plus 7-10% platform fees, totaling 22-25% of media spend while combining partner expertise with customer involvement in campaign operations.

Technical integration capabilities vary among activation partners, with some offering white-label service portals, dynamic creative solutions, full reporting visualization suites, and offline attribution measurements. Advanced partners provide complete Amazon Marketing Cloud integration, enabling sophisticated audience development and campaign optimization strategies that leverage Amazon's comprehensive data ecosystem.

Amazon DSP's growing ecosystem of advertising technology partnerships demonstrates the platform's commitment to providing advertisers with flexible access options and specialized expertise. The activation partner program codifies relationships that enable smaller advertisers to leverage enterprise-level capabilities without meeting traditional platform access requirements. This strategic approach expands Amazon's advertiser base while maintaining service quality through vetted third-party partnerships.

The formalization reflects broader industry trends toward specialized advertising technology partnerships as platforms seek to balance direct relationships with channel partner accessibility. Amazon's documentation emphasizes that activation partners undergo rigorous vetting processes, including security audits and performance evaluations, ensuring quality standards across the partnership network.

For marketing professionals evaluating Amazon DSP access options, the activation partner model provides entry points that traditional direct platform access cannot accommodate. Smaller advertising budgets, limited technical resources, or specific industry expertise requirements may make activation partners more suitable than direct Amazon relationships or large agency partnerships.

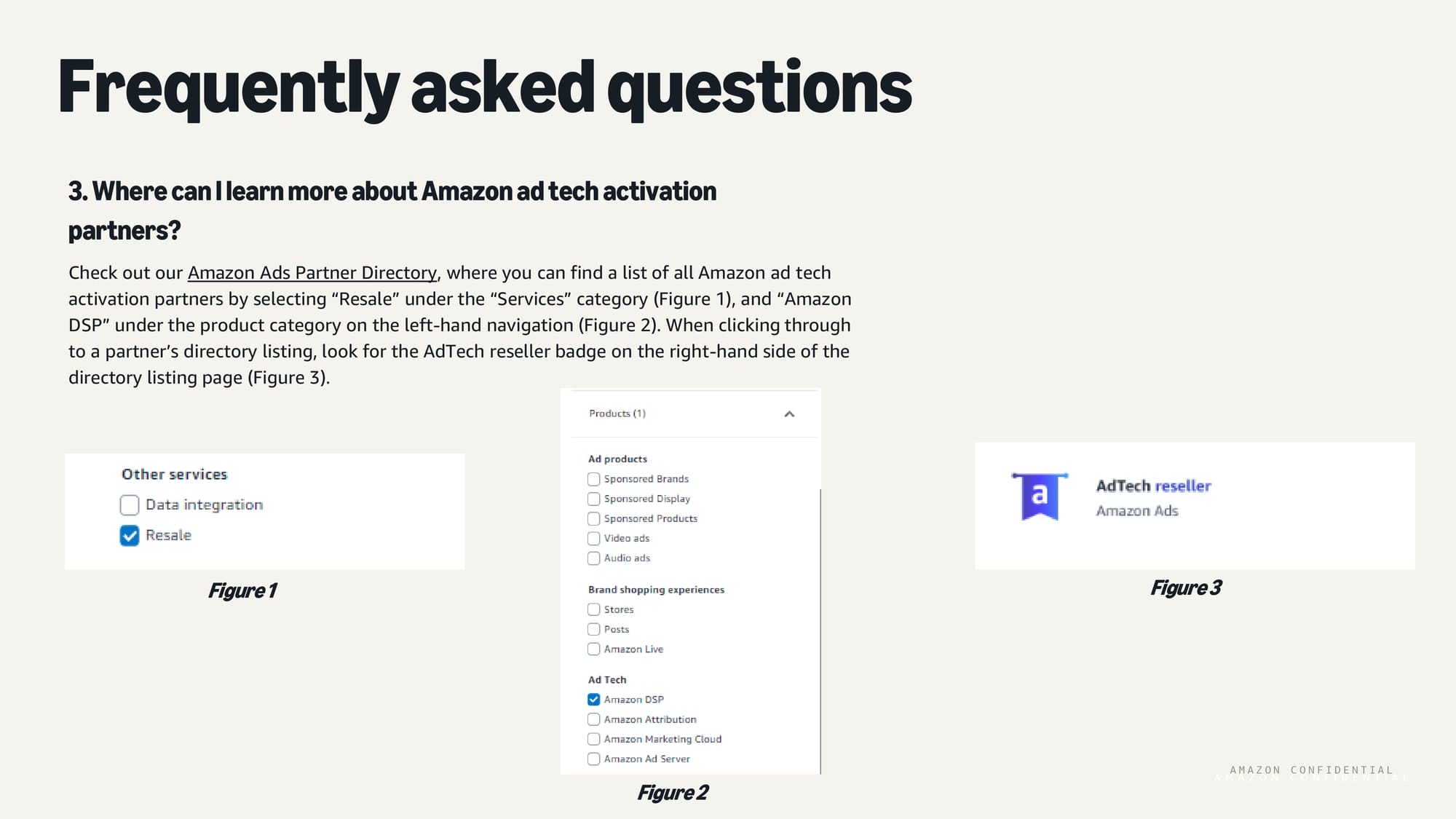

The comprehensive partner directory enables detailed comparison of service offerings, certifications, geographic coverage, and industry specializations. Partners display badges indicating their specific qualifications, including AdTech reseller status, advanced partner designations, and award recognition for exceptional client service or campaign innovation.

Amazon's partner program documentation indicates ongoing expansion plans, with new partners added regularly following approval processes. The company continues investing in partner training and certification programs to maintain service quality standards while expanding access to Amazon DSP capabilities across diverse advertiser segments and geographic markets.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Key terminology explained

Amazon Marketing Cloud (AMC): Amazon's clean room data analysis environment enables advertisers to perform privacy-safe audience analysis and measurement across Amazon's advertising ecosystem. AMC processes aggregated and anonymized data to generate insights about campaign performance, audience overlap, and conversion attribution without exposing individual user information. Advertisers upload their first-party data to create custom audiences and measure campaign effectiveness across Amazon DSP, sponsored ads, and external media channels. The platform supports SQL-based queries for advanced analytics while maintaining strict privacy controls through differential privacy techniques and minimum aggregation thresholds.

Demand-Side Platform (DSP): A technology platform that enables advertisers and agencies to purchase digital advertising inventory programmatically across multiple ad exchanges and supply sources through automated bidding systems. Amazon DSP specifically provides access to Amazon-owned properties like Prime Video and Twitch, plus third-party publisher inventory through real-time bidding. The platform uses machine learning algorithms to optimize campaign performance based on advertiser-defined goals such as conversions, reach, or brand awareness. DSP technology eliminates manual insertion order processes by enabling automated, data-driven media buying at scale.

Programmatic Guaranteed Deals: Pre-negotiated advertising agreements between advertisers and publishers that combine programmatic technology automation with guaranteed inventory delivery and fixed pricing. Unlike open auction programmatic buying, these deals ensure specific impression volumes, premium placements, and predetermined costs per thousand impressions (CPM). Publishers reserve high-quality inventory for programmatic guaranteed buyers, providing brand safety and contextual relevance guarantees. The automated delivery system maintains the efficiency benefits of programmatic technology while offering the predictability and premium positioning of traditional direct sales.

Supply Path Optimization (SPO): Strategic approach used by advertisers and demand-side platforms to streamline the complex chain of intermediaries between ad buyers and publishers in programmatic advertising. SPO reduces auction duplication, improves bid efficiency, and increases transparency by identifying the most direct and cost-effective paths to reach premium inventory. This optimization process evaluates supply-side platforms, ad exchanges, and publisher connections to eliminate unnecessary technology fees and latency. Advanced SPO implementations use data analytics to measure path performance and automatically route bids through optimal supply chains.

Seat-Sharing Model: Business arrangement where established DSP license holders provide platform access to advertisers who cannot meet minimum spend requirements or technical infrastructure demands for direct platform relationships. The seat owner maintains the primary platform relationship, handles technical integration, and provides customer support while sub-users access DSP functionality through the shared license. This model enables smaller advertisers to leverage enterprise-level advertising technology without substantial upfront investments or complex technical implementations. Seat-sharing typically involves revenue-sharing agreements and may include additional services like campaign management or optimization guidance.

Clean Room Technology: Privacy-preserving data collaboration infrastructure that enables multiple parties to analyze combined datasets without exposing raw personal information or proprietary business data. Clean rooms use advanced cryptographic techniques, differential privacy, and secure multi-party computation to generate aggregated insights while maintaining strict data isolation. Participants can measure advertising effectiveness, develop audience segments, and optimize campaigns using first-party data collaboration without compromising individual privacy or competitive intelligence. This technology addresses growing privacy regulations while enabling sophisticated marketing analytics and attribution measurement.

First-Party Data Signals: Information collected directly by companies from their own customer interactions, including website behavior, purchase history, email engagement, mobile app usage, and customer service touchpoints. Unlike third-party data purchased from external sources, first-party signals provide accurate, consented, and contextually relevant customer insights. These signals enable precise audience targeting, personalization, and conversion optimization while complying with privacy regulations. Advanced implementations combine first-party signals with machine learning to predict customer behavior and optimize advertising delivery across multiple channels and touchpoints.

Real-Time Bidding (RTB): Automated auction system that enables advertisers to compete for individual ad impressions in real-time as web pages load or mobile apps initialize. RTB transactions occur within 100 milliseconds, evaluating user data, context signals, and advertiser targeting criteria to determine optimal bid prices. The system allows granular audience targeting and dynamic pricing based on impression value, enabling efficient media buying at scale. RTB infrastructure supports multiple bidding strategies including first-price auctions, header bidding, and unified auction mechanisms across display, video, and mobile advertising formats.

Attribution Measurement: Analytical methodology for determining which marketing touchpoints contribute to desired customer actions such as purchases, sign-ups, or app installations. Multi-touch attribution models assign conversion credit across multiple advertising channels and interactions throughout the customer journey. Advanced attribution systems use machine learning to analyze complex interaction patterns, account for assisted conversions, and measure incrementality across online and offline channels. Amazon's attribution capabilities leverage comprehensive retail data to measure advertising impact on both immediate purchases and longer-term customer value.

Streaming TV (STV) Inventory: Premium video advertising placements within over-the-top television content delivered through internet-connected devices rather than traditional broadcast or cable infrastructure. STV inventory includes ads shown during streaming content on platforms like Prime Video, Hulu, Disney+, and connected TV apps. This inventory typically commands higher CPMs due to engaged viewing experiences, advanced targeting capabilities, and growing audience migration from linear television. STV campaigns leverage household-level targeting, cross-device measurement, and integration with e-commerce data to measure advertising effectiveness beyond traditional TV metrics.

Timeline

- 2015: Acadia.io begins managing Amazon brand accounts, coinciding with the first Prime Day event

- 2017: Multiple partners including B2MarketPlace and Witailer establish Amazon advertising specializations

- July 2021: Amazon launches Partner Network program for agencies and tool providers

- November 2023: DoubleVerify integration with Amazon Custom Audiences launches

- February 2024: Amazon DSP Events Manager expands with Mobile Measurement Partner integrations

- March 2024: Programmatic guaranteed deals for video expand to Japan, Saudi Arabia, Turkey, and UAE

- June 2024: Amazon Publisher Cloud clean room technology launches

- June 2024: Magnite joins Amazon Ads Certified Supply Exchange Program

- September 2024: Amazon DSP Similar Audiences beta feature launches using AI targeting

- October 2024: Amazon DSP unveils next-generation advertising technology with Performance+ enhancements

- January 2025: Amazon Retail Ad Service extends technology to third-party retailers

- April 2025: Sponsored Display optimization improvements implement machine learning algorithms

- May 2025: Amazon advertising business grows 19% to $13.9 billion in Q1 2025

- June 2025: Disney inventory integration with Amazon DSP launches access to Disney+, ESPN, and Hulu

- July 2025: Amazon Ads formalizes ad tech activation partner program structure and requirements